|

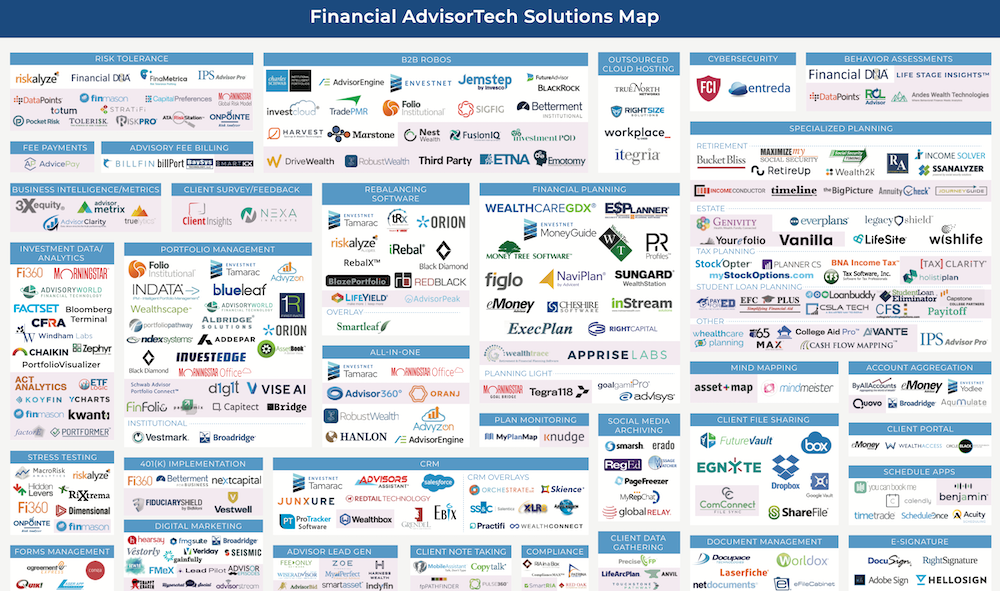

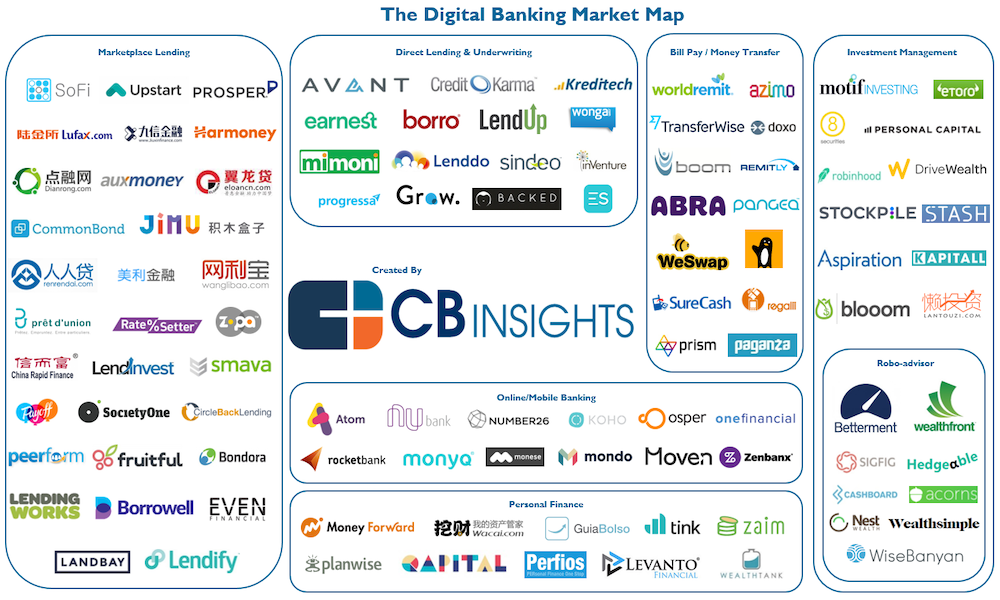

At AFIEA, we we see the present financial technology solutions are mainly focusing on automating traditional repeated operational tasks. With the rapid increase of computing power and advances in artificial intelligence and machine learning, new AI applications are being created and developed every year to improve financial services for better serving investors. Our expertise with our consulting partners is growing with continued cooperation and up-to-date financial technology research.

The following are a few selected Fin-Tech areas that are believed to grow based on our recent consulting projects, market research, and technology prediction. You are welcome to contact us for any questions about financial services-related technology & intelligent solutions. Contact us if you have any questions or comments.

|

The computational power has revolutionized the fintech companies. In particular, data and the near-endless amounts of information are transforming AI to unprecedented levels never seen before.

|

Intelligent Wealth Management

Portfolio rebalancing tools - Realign portfolios to match target weightings or execute changes in weightings, incorporates tax efficiency, or other execution optimization.

Portfolio risk management tools - Allow advisors to conduct portfolio analytics. They can be advisor-facing only or can create client-facing reports and facilitate advice around risk trade-offs. |

|

Intelligent Portfolio Management

Investment outsourcing with robo-advisors – Allow advisors to outsource investment decisions and focus on relationship management and client acquisition.

AI-powered equity ETF - The new exchange-traded fund is actively managed and invests primarily in equity securities based on the results of a quantitative model utilizing artificial intelligence, machine learning, and big-data applications. |

|

Intelligent Security

Intelligent cybersecurity platform - Protect the complete attack surface with automated threat prevention, detection, and response capabilities. Provides real-time visibility into all network-connected endpoints, including traditional and mobile devices, across complex wired and wireless networks.

|

|

Intelligent Payment

Payment acceptance - Enable the acceptance and processing of digital payments with intelligent financial commerce platforms.

Intelligent payment - Ability to issue your own secured payment instruments, leverage physical and virtual cards to let your customers or employees pay across all channels. |

|

Intelligent Banking

Digital Banking - Consumers' growing desire to access financial services from digital channels has led to a surge in new banking technologies that are reconceptualizing the entire retail banking market. Technology has its hand in seemingly every aspect of the banking industry. The influence of technology will continue to launch banking into a digitized future.

|

|

Intelligent Trading

Electronic trading - Digital technology for market making helps asset managers, central banks, hedge funds and investors access the liquidity they need through a range of electronic marketplaces.

Portfolio trading - Portfolio trading for ETFs and bonds is becoming a vital new liquidity source for clients seeking to trade large, complex baskets more efficiently. |

|

Intelligent Data Analysis

Data analysis - Develop algorithms to extract valuable information from text to optimize knowledge tasks focusing on content organization, consumption, distribution and analysis.

Data comprehension - Read, understand, reason, and answer questions about unstructured natural language text. |